Why the New DRV (German Pension Insurance) Regulations Coming in 2027 Could Change Freelancing As We Know It.

How wellness studios and teachers can prepare now.

Written by Yasemin Ege Vollmond

The German Pension Insurance (DRV) is changing its rules from 01.01.2027, to decide whether teachers are allowed to work as self-employed freelancers or must be hired as employees by their studios. This particularly affects yoga teachers, sports and fitness trainers, Pilates trainers, dance teachers and music teachers, i.e. professions that are traditionally practiced as freelance, self-employed teaching activities.

(source: Bakertilly, April 2025 and DRV Meldung, February 2025)

Many teachers enter the wellbeing industry as self-employed freelancers without fully understanding the system they are stepping into. They often arrive with a genuine and beautiful intention: to share something that supported them on their own path: body awareness, mindfulness, strength, movement, music. But then: German bureaucracy hits.

I’ve been there when teachers knock on the studio door in distress, holding their letters from the Finanzamt or the German Pension Insurance (DRV; Deutsche Rentenversicherung):

“You are required to pay 18.6% in pension contribution of your income, sometimes retroactively for up to 4 calendar years (based on § 25 SGB IV), if your monthly earning exceeds 603€.”

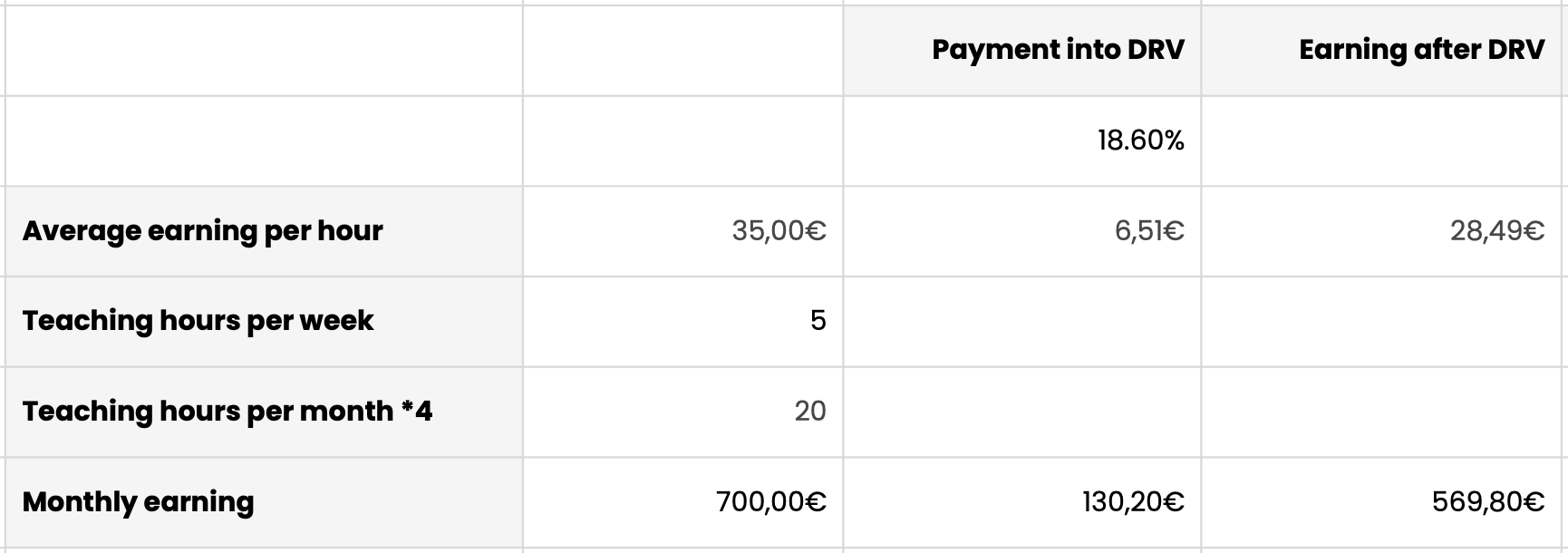

Let’s look at the reality for teachers paying into the DRV:

A teacher in Berlin might earn around 35€ per class. If a teacher gives five classes per week, this results in around 20 classes per month. At 35€ per class, the monthly income is 700€. Once the threshold of 603€ is crossed, pension insurance becomes mandatory. At a contribution rate of 18.6%, this means a monthly payment of 130,20€ to the statutory pension system. The remaining income is 569,80€.

If a teacher were to be employed by a studio, then 50% of the DRV contribution would be paid by their employer. In the case of self-employed freelance teachers, the whole amount has to be paid by them.

DRV and “Scheinselbständigkeit”

The DRV’s legal mandate is to protect the social security system in Germany. They have to ensure that people who are actually working as employees are properly insured and that social security contributions are paid. But in recent years, the DRV has increased its focus on so-called “Scheinselbständigkeit” (bogus-self employment). To my knowledge, they checked many industries and uncovered cases where people were formally declared self-employed but were, in practice, fully dependent on a single employer.

Why teachers and studios are now in focus by DRV:

From the DRV’s perspective, Scheinselbstständigkeit exists when someone is formally self-employed, but functionally works like an employee. The key question is not “Are you a freelancer?” but “Do you work under conditions that look like employment?”.

Teachers in the wellbeing industry work with multiple studios, schools or institutions. However, the teaching relationship with a studio may be classified as Scheinselbständigkeit if a teacher:

Teaches regularly at fixed times within a studio’s timetable

Is visibly integrated into the studio’s core offering

Uses the studio’s rooms and equipment

Has their classes marketed and sold by the studio

Works under conditions that resemble staff responsibilities: check in, check out, cleaning of space

And to be honest, I’ve seen this happening in most studios. Because that’s how their business model is currently structured and operating.

So here is what is changing with the new DRV rules in 2027:

From 1st of January 2027, the DRV will apply stricter criteria to determine whether teachers can work as self-employed freelancers or must be hired as employees. In practice, this means that many teaching arrangements that have long been considered freelance may no longer qualify as self-employment after 2027.

I’ve contacted the Deutsche Rentenversicherung via meinefrage@drv-bund.de and asked for advice for teachers who wish to protect their self-employed status:

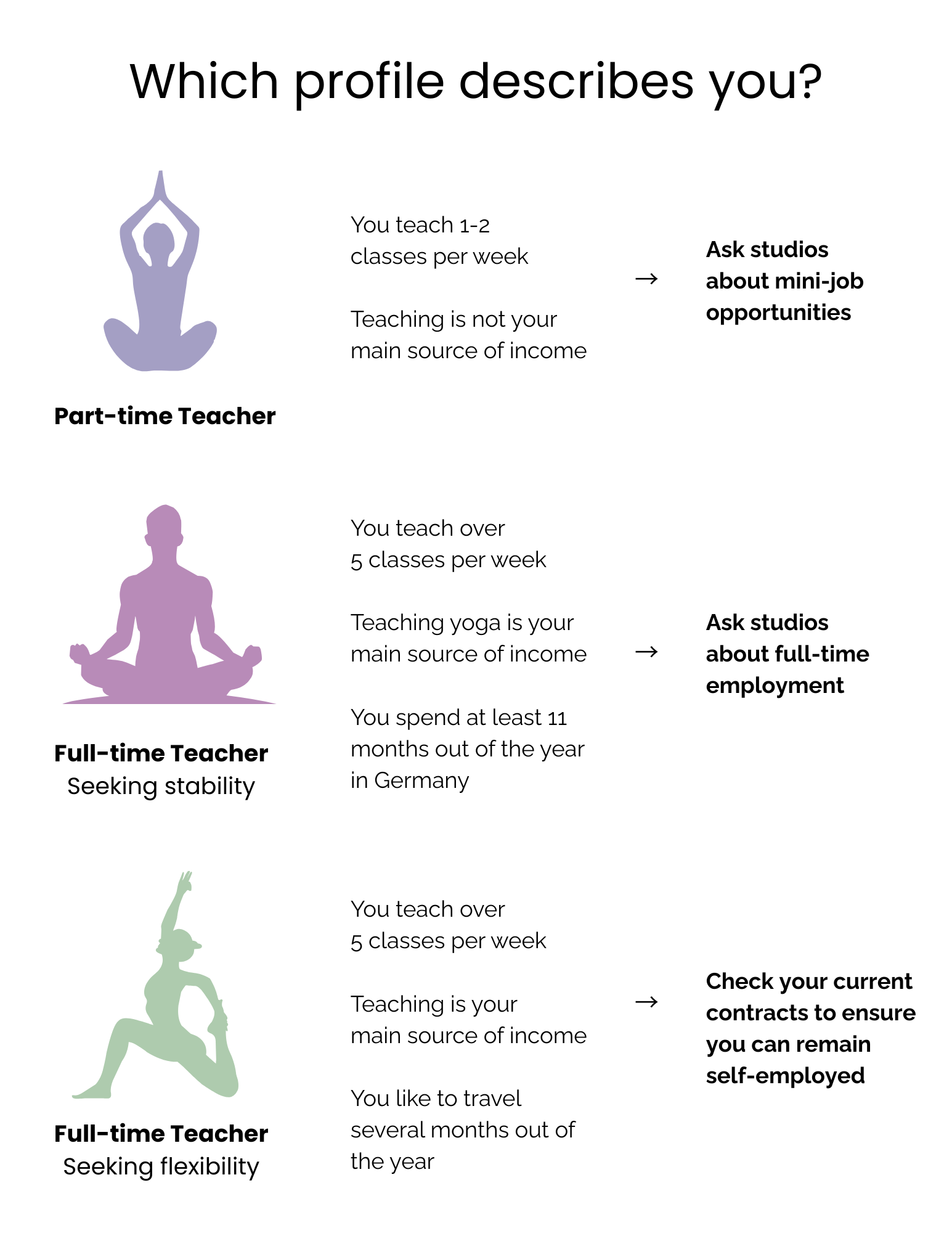

If you are working as a self-employed teacher (paid per class, with a contract that treats you as self-employed) → the transitional rule gives you extra time until 2027 before automatic employment/social insurance claims apply.

Here is what you can do to prepare for 2027:

Get clarity on your current status

You must check that your contracts genuinely reflect self-employment (and you signed them as such) to qualify for the rule. Studios hiring you must ensure your contract clearly reflects self-employment and both parties explicitly agree. Otherwise, from 2027 they may face retrospective claims for employment status or social contributions.

What to watch out for:

If you have fixed hours, fixed place of work, little freedom to teach elsewhere, you risk being re-classified as an employee

You may have to pay social insurance or reduced contributions if classification shifts

Better to secure your contract now, clarify status with a lawyer or insurer

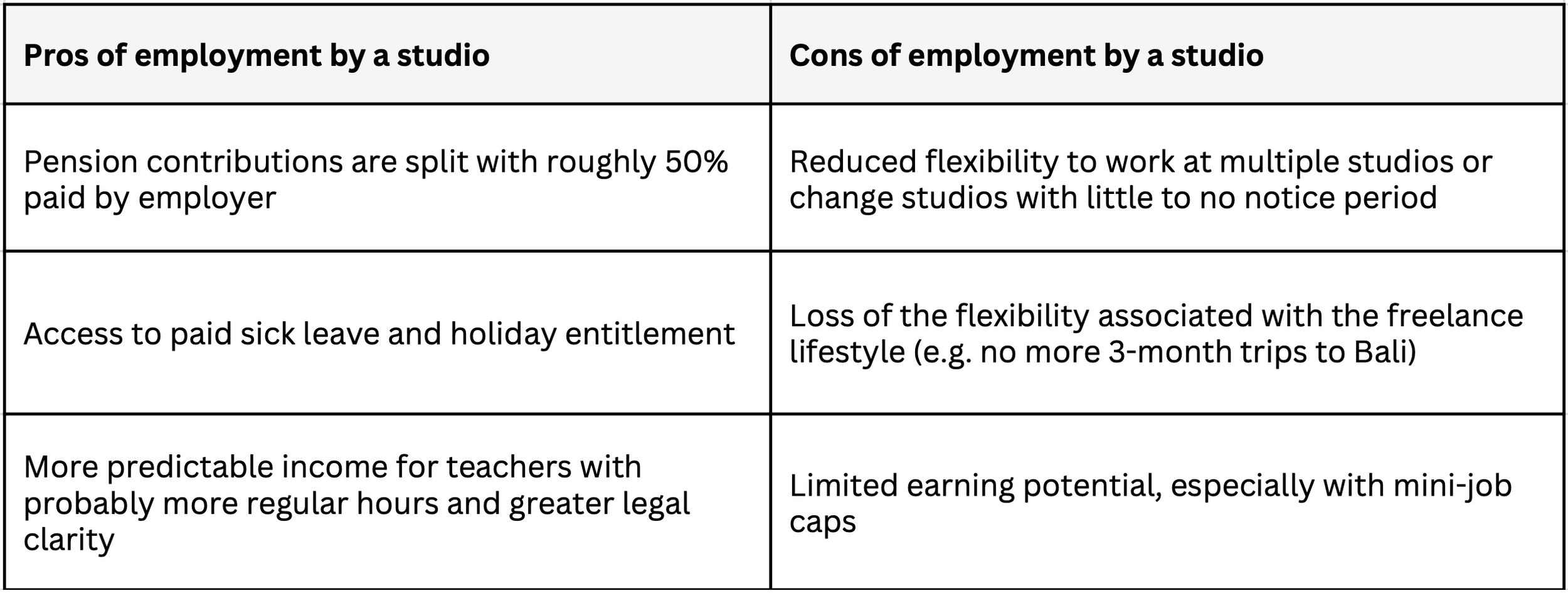

Talk to your studios about what mini-job and employment opportunities at the studio could look like to make an informed decision

3. Practical tips you can take now (based on DRV guidance)

According to the DRV, a binding decision on whether you are self-employed or employed can only be obtained through a formal status determination procedure (Statusfestellungsverfahren).

This procedure must be applied in writing and assessed on the basis of

Your contract

And how the work is actually carried out in practice

→ Status determination is a concrete option through the following forms:

Teachers and studios who want legal clarity can apply for a Statusvestellungsverfahren via the DRV clearing office.

This requires submitting:

The supplementary form (C0031)

Existing contracts or agreements

This is not a quick fix, but is currently the only formal path to legal certainty.

Take a deep breath, navigate this with groundedness and get support if this seems overwhelming.

About Yasemin Ege Vollmond

Yasemin is a certified breath and sound therapist, musician and studio founder. With a background in economics, corporate management and international marketing, she bridges strategic thinking with embodied wellbeing practices. Alongside her work in venture capital and regenerative real estate, she consults studios and wellbeing facilitators on sustainable structures. Her practice includes Sound Music Trainings in Gongs and bi-weekly Online Breathwork Sessions.

Upcoming Sound Music Gong Trainings

22 hour Hybrid Gong Training week with focus on Paiste’s Planetary Gongs March 9th - March 13th, 2026 / only 3 seats left📍 Munich, Germany

Special price for Soul Collective Readers: 555€Bi-weekly Online Breathwork Class

Online Breathwork with Yasemin

Mondays at 19.00 / Next class February 2nd, 2026

via The Portal and USC check-in via “Online Greenyoga Kreuzberg”

Stay up to date by connecting with Yasemin on Instagram and LinkedIn.